The Central Bank of Nigeria (CBN) changed its forex (FX) policy to give commercial banks the leeway to sell foreign currencies. In a follow-up announcement on its official Twitter page, the country’s financial institution clarified some of the information from its new policy.

For example, it confirmed that the 43 restricted items are still not permitted to be funded from the Investors’ and Exporters’ (I & E) FX Window. This means that importers of items like rice, palm oil products, meat, diary, maize, and so on are not permitted to access forex.

Since everyone who needs FX has to still apply through banks, it should be easy to maintain the policy on restricted items. However, what about agriculture?

Is the new CBN forex policy good or bad for agriculture?

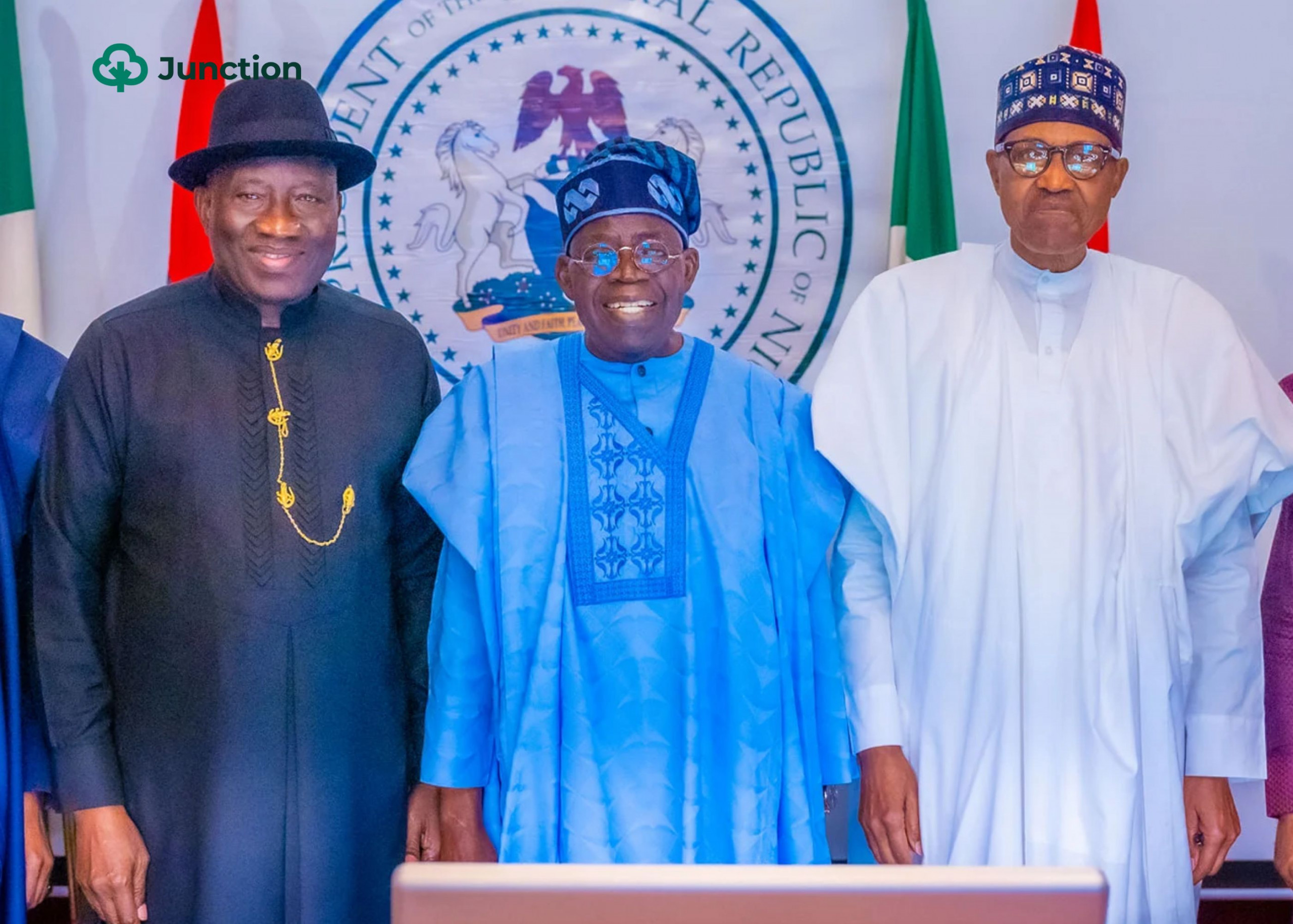

Before we consider its effects on the agriculture sector, we need to understand what the policy aims to achieve. Coming right after President Tinubu mentioned merging the exchange rates on several markets in the country, it is clear that this move aims to achieve that.

The previous restrictions on forex price in Nigeria meant that while commercial banks had a price of around ₦450 to a dollar, for example, it was difficult to jump through the hoops to obtain it. One reason was that FX was scarce and commercial banks rationed it to get the maximum profit from the transaction. Instead, many people, especially those without access to speedy approval, had to turn to the black market where a dollar was selling at as high as ₦750 or more.

CBN devalues the Naira

According to a report, commercial banks in Nigeria are now selling dollars at ₦700 and buying at ₦699. What this means is that while the move to merge FX markets may work, the CBN has effectively devalued the Naira even further.

On paper, devaluing the Naira should have such effects as boosting exports as Nigerian goods and services become more affordable in international markets. It could also encourage import substitution as locally produced goods become more affordable than imports. This shift in consumer behaviour can boost local production and manufacturing. Also, foreign investors can easily acquire more assets with lower foreign currencies.

Increased inflationary pressure

Notice how the previous paragraph started with ‘on paper’. This is because there are several consequences of devaluing the Naira, as we have seen in recent years. For example, weaker currency has led to inflation pressures on goods while reducing purchasing power as many income are fixed. Look at the prices of selected food prices in the last six years when Naira to a dollar moved from ₦197 to ₦450.

Agricultural products, which have some level of protection from FX pressures, have not fared any better. In fact, recent reports show that they lead the overhead inflation recorded in the country. Imports on restricted products have not slowed down because some businesses have special licenses to keep importing them, like Arla Foods for dairy milk.

A more import resilient economy would have benefitted greatly from the Naira devaluation and the new policy to allow commercial banks trade FX trade freely. However, Nigeria’s agriculture is overly dependent on imports. As this article shows, the agriculture sector has been showing a negative trade balance for the last 16 quarters or more.

New FX policy could increase capital importation

With past evidences, there is little to no glimmer of hope in sight for Nigeria’s agriculture even with the new CBN forex policy.

While it could mean enhanced market efficiency as new rates better reflect economic fundamentals and are governed by supply and demand dynamics. The people may still be looking at increased cost of living.

Of course, foreign investors would be heartened that they can better predict the country’s FX environment and take out their money when they need to, instead of having it trapped. Foreign capital importation can increase economic activities and create jobs while introducing new technology and expertise. The Nigerian agricultural sector can do with this financing and innovation, but there is no assurance that the pendulum will swing that way yet.

However, for agriculture to benefit from a freely traded forex system, local production must increase. It is not enough for the government to ban imports if there is not enough domestic supply to satisfy needs, look at this report on crude palm oil importation to see an example. Instead, a ban makes importers pay above the official rate for products and pass the burden to consumers.

Conclusion

In conclusion, the new CBN forex policy devalues the Naira further, makes it easier for approved importer and exporters to access it, but increases the cost on imported goods, of which agricultural products are in the majority.

Thus, it is easy to predict inflation on food and increase in foreign investments. The agric sector financing may still need some tweaking to attract investors as more of the new capital will likely go into the banking sector as latest statistics showed.

In itself, the policy does not do much good for the sector. It will need deliberate polices and interventions to favour agriculture. We will keep a close watch on what Tinubu’s administration does next that affects the agric sector to improve food security in the country. Subscribe to our newsletter to stay informed.