News in brief:

– Recent commodity price trends in Nigeria show mixed impacts, with sharp increases in soya beans and declines in raw cashew affecting both input costs and export earnings.

– These fluctuations pose challenges for consumers, agribusinesses, and the broader economy, highlighting the need for improved market regulation and risk management.

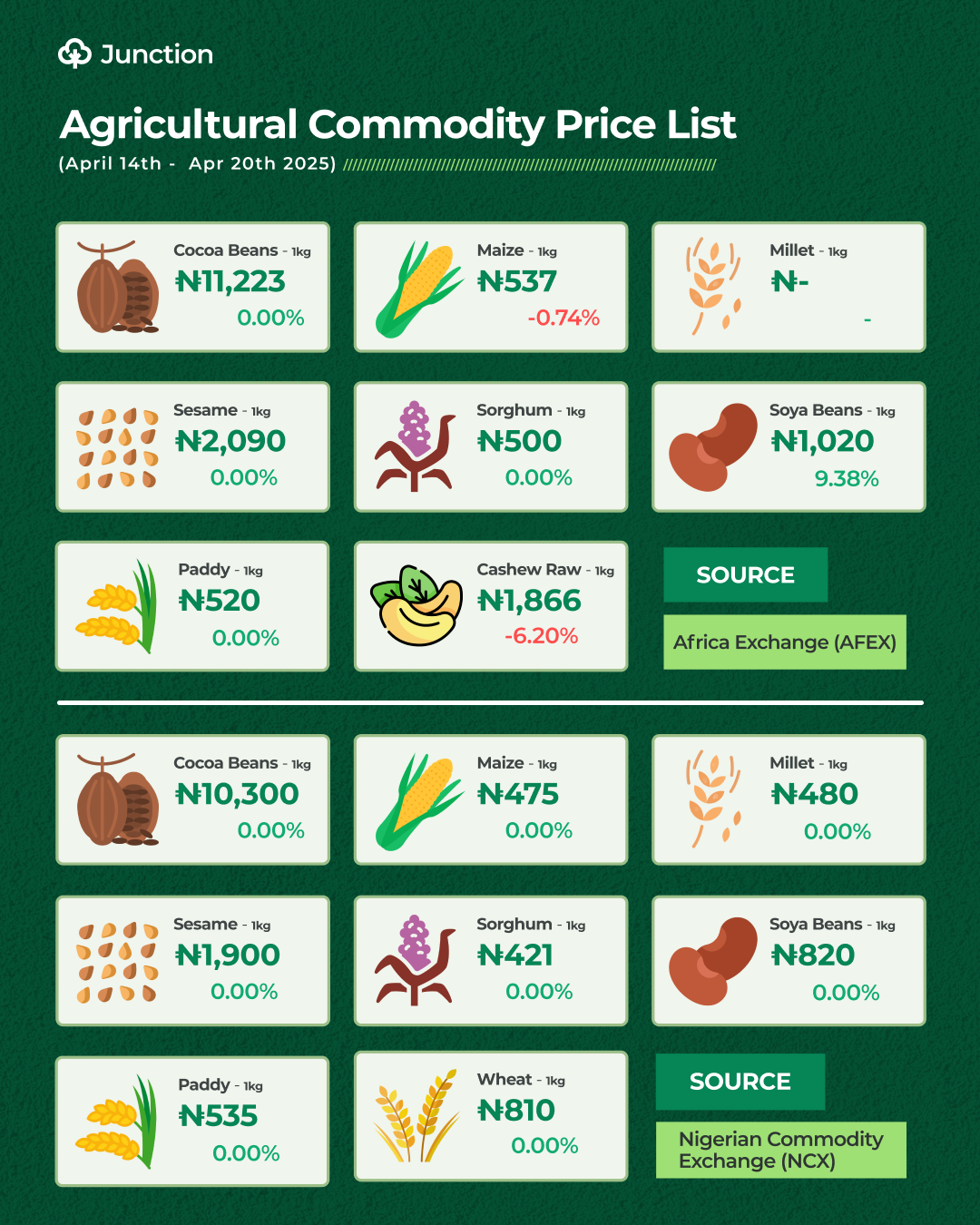

Commodity price movements in Nigeria over the past two weeks reflect a mixed picture for consumers, industries, and the broader economy, according to data from AFEX.

Soya beans experienced a sharp increase of 9.38% in the past week, up from a 1.86% rise the previous week. This surge could raise input costs for food processors and livestock feed producers, potentially pushing up retail prices of protein-based products.

Meanwhile, raw cashew prices reversed course with a steep 6.20% drop, following a significant 9.22% rise earlier. This volatility could impact export margins and farmer incomes in key cashew-producing states.

Maize prices continued their downward trend, albeit modestly, falling by 0.74% after a 0.55% dip the previous week. This may provide slight relief for poultry farmers and feed manufacturers, although sustained price stability remains essential.

Sorghum and paddy rice prices remained unchanged this week, indicating a short-term pause in market movement after paddy’s notable 6.58% decline in the preceding week.

Cocoa beans showed no price change this week after a 6.19% jump earlier. While stability is welcome, the prior surge might have already introduced cost pressures on cocoa processors and exporters, affecting competitiveness in global markets.

Overall, these fluctuations have varied implications. Rising input costs could strain household budgets and consumer spending, especially in urban areas.

For industries, especially in agribusiness and food production, unpredictable commodity pricing complicates planning and affects profit margins.

On a macroeconomic level, price swings in key export crops like cocoa and cashew influence foreign exchange earnings and trade balances.

To safeguard economic stability, stakeholders may need to intensify efforts in market regulation, storage infrastructure, and commodity-based risk management. AFEX’s consistent data tracking offers a vital lens for understanding these dynamics in Nigeria’s agricultural economy.