News in brief:

– TAO, developed by Agromall, is empowering Nigerian youths by combining agricultural loans with practical training through its digital bank, BOAT.

– By addressing key barriers like funding and skills gaps, it is helping a new generation of agripreneurs build successful ventures in farming and agribusiness.

The Agriculture Option (TAO) is promoting financial inclusion in Nigeria’s agriculture sector by offering a smart solution that combines funding with capacity building to attract more young people to the industry.

This ecosystem was developed by a team at Agromall Discovery and Extension Ltd, an agritech firm previously known for building the AgroMall Digital Agricultural Platform (ADAP). Leveraging the experience gained from developing that mobile and web-based application, the team has now launched a more targeted initiative.

A key insight driving the project is that more young Nigerians are interested in agriculture and the food sector than is often assumed. Surveys and engagements revealed that the biggest barriers to entry were a lack of funds (60%) and a lack of specialised training (17.9%).

Armed with this data, TAO set out to bridge the gap between aspiring agricultural students and those already practising in the field.

The company’s loan initiative focuses on helping young people get started, rather than just making agriculture appear trendy.

“I’ve always believed in ‘packaging’ agriculture in a clean and presentable way to make it look cool and acceptable to young people. Alas, it feels like we’re on our own—many young people just don’t care,” said TAO Managing Director, Femi Adeniyi.

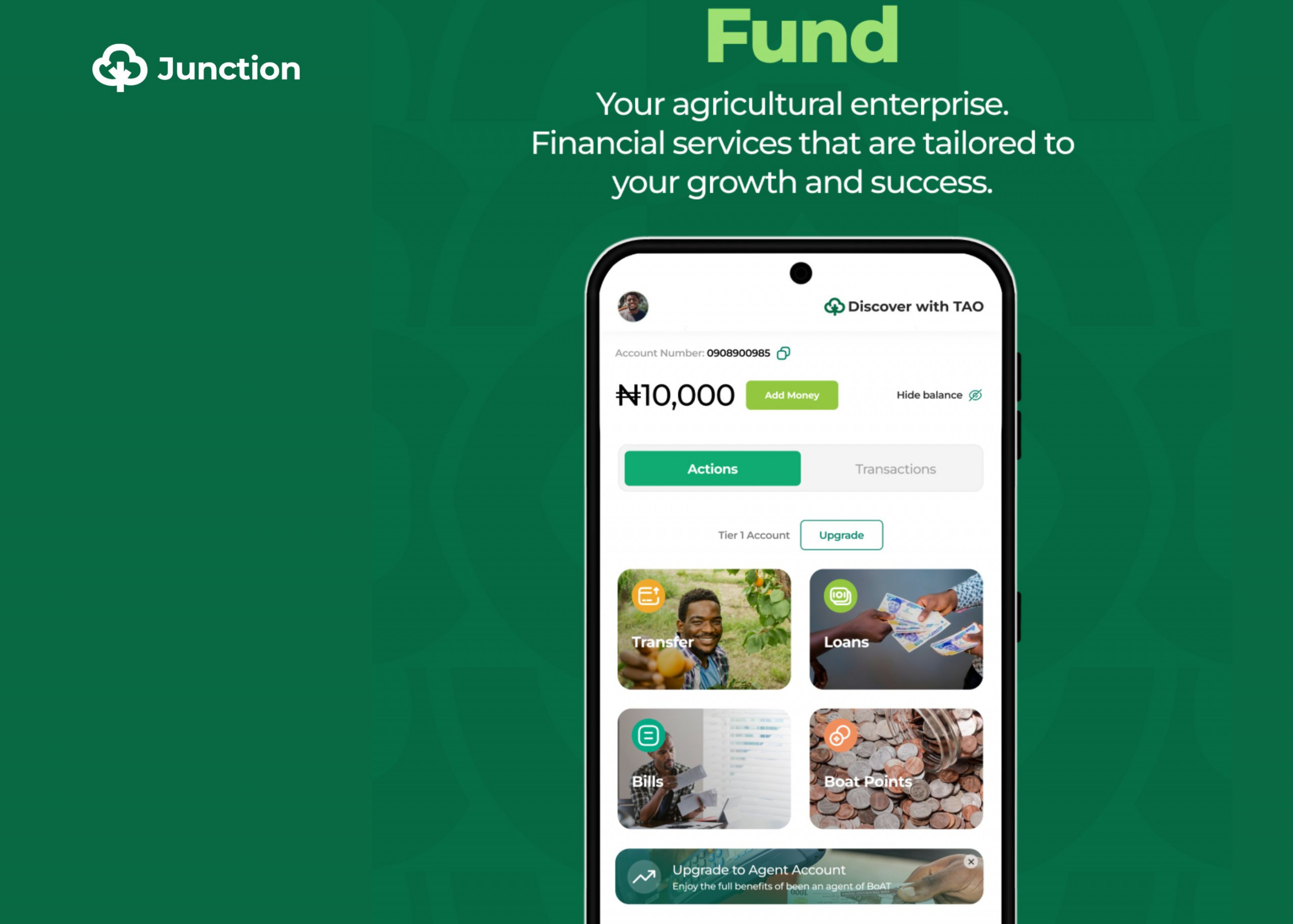

Through its Bank of Agricultural Transformation (BOAT), TAO offers loans to young entrepreneurs for up to five hectares of farmland or the equivalent in poultry, fish, and livestock ventures.

BOAT’s user-friendly digital platform enables quick, easy access to agricultural credit and financing, supporting both individual and corporate ventures with terms tailored to the unique needs of Nigeria’s agriculture sector.

What sets BOAT loans apart?

Unlike traditional loan schemes that rely on external assessments and bureaucracy, BOAT integrates its qualification tools directly into the mobile app.

Applicants can complete expert-designed courses and assessments through the Young Ranchers feature, which offers practical training in farming, processing, and agribusiness.

View this post on Instagram

This capacity-building approach ensures that applicants are equipped to maximise their loans and potentially earn up to ₦5 million in their first year. The app also includes a Circle feature, connecting agribusiness owners with global supporters and investors interested in their ventures.

BOAT’s expert validation process further distinguishes it by ensuring that only prepared applicants receive funding. The team of professionals:

-

Reviews course performance and assessments to confirm mastery of the material.

-

Evaluates practical skills and resource management capabilities in the chosen area.

-

Provides tailored guidance to enhance applicants’ skills and increase approval chances.

TAO’s goal is to ensure that every loan goes to individuals who are capable, prepared, and driven to succeed. With this structure, young Nigerians are not only getting access to funds, they’re gaining a support system designed to help them thrive.