Guarantees are still a more sustainable way to stimulate productivity in Nigeria’s agriculture and food production —a brief look at the current agricultural food production financing effort.

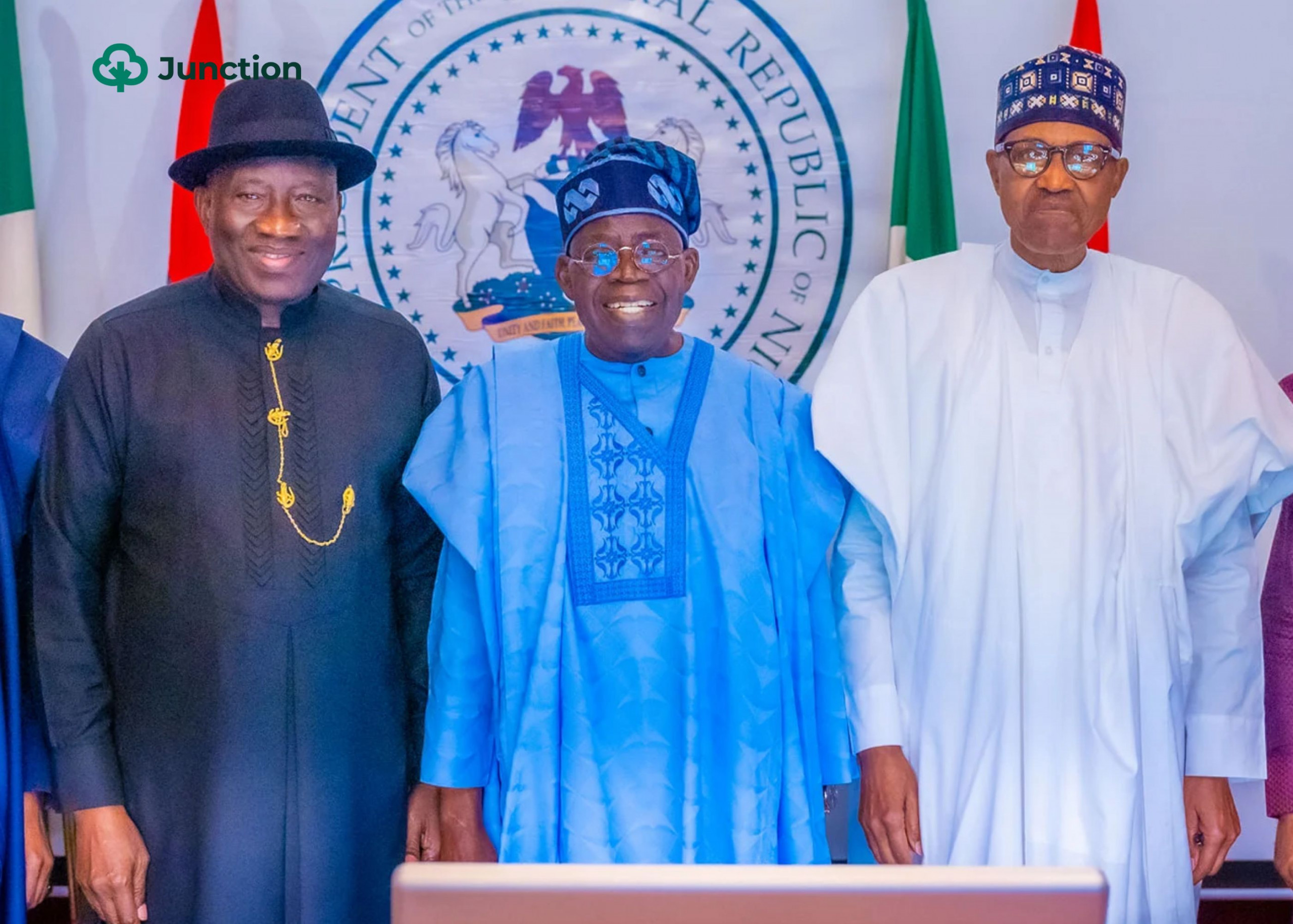

As food prices-led inflation reaches an all-time high of over 28.9%, the administration of President Tinubu has continued to demonstrate its commitment to supporting agriculture for food security and job creation, as captured in his Renewed Hope agenda.

Recent efforts to support agriculture-particularly improved food production are being channeled through the Federal Ministry of Agriculture and Food Security to support farmers with subsidised input, a departure from the Central Bank-led direct credit interventions and guarantees for credit through NIRSAL. This is undoubtedly a fallout of the poor performance of these interventions and mechanisms in the last 8 years.

Ironically, a 50% subsidy on input, which amounts to a grant or unrecovered spend is still about the same as the defaults (unrecovered) rates on credit interventions such as Anchor Borrowers’ Programme (ABP), bringing us back to a situation of not recovering or expanding spend on agricultural efforts through revolving financing activities.

Unfortunately, subsidies on input are without the attendant impact of expanding agricultural financing which financial services tools such as guarantees mechanisms or credit interventions will provide, and which Nigeria desperately needs to bridge its $200 billion agricultural financing gap.

It is also reported from the field that most of the issues that plague agricultural interventions such as input diversion and side selling still plague the current one, thereby facing the same issues without an opportunity for catalysing through leverage and development of the injected fund.

Here are some comparisons of the past and current approaches:

As the CBN looks to guarantee mechanisms to stimulate financing for sectors like real estate and consumer lending, a reformed NIRSAL still has important roles to play in Nigeria’s agricultural financing, as it is important that guarantees feature prominently in the country’s outlook for financing its agriculture for transformation and optimal productivity.

Hmmm