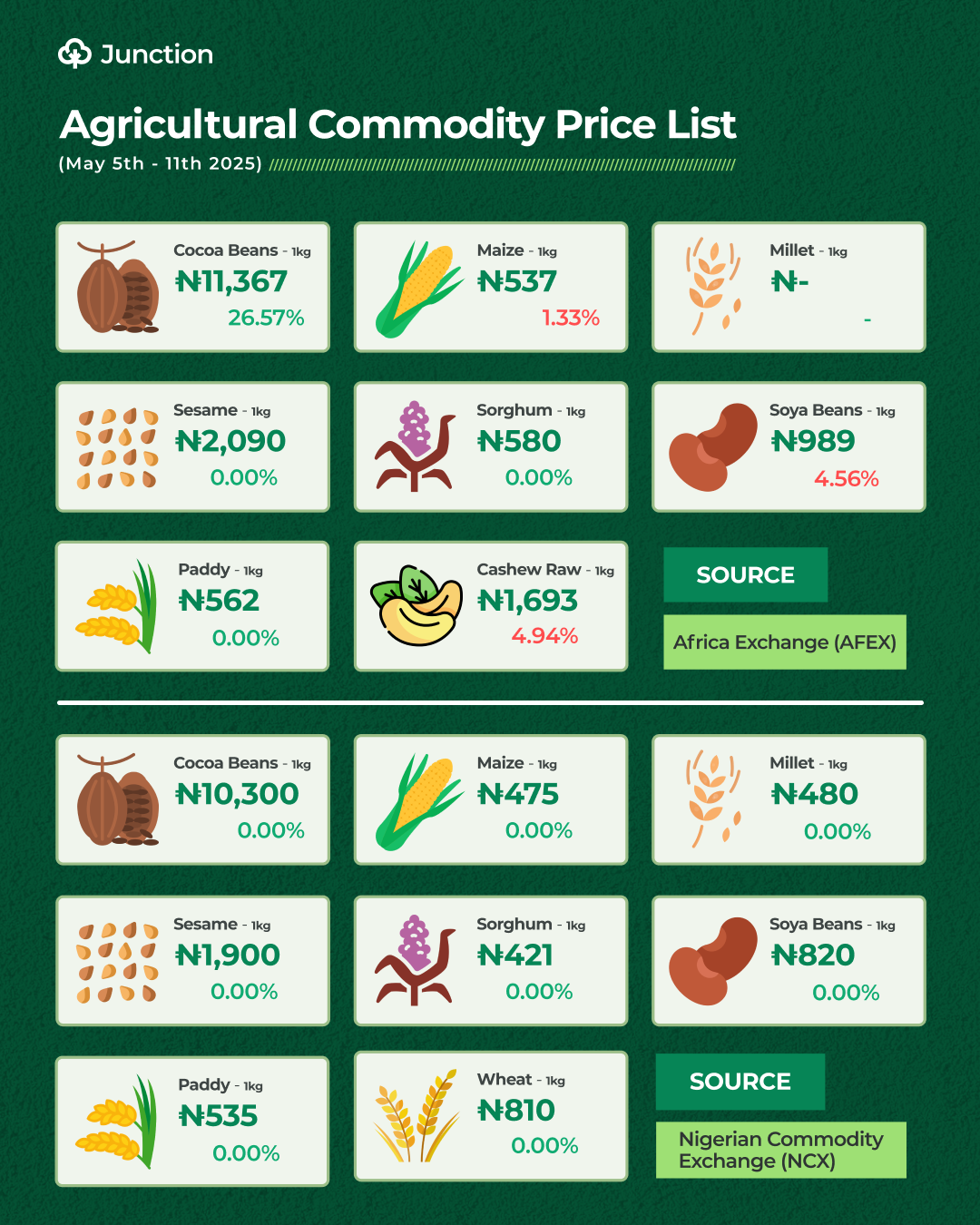

Over the past six weeks, the price of raw cashew in Nigeria has dropped by 7%, according to data from AFEX. In just the last week, prices slid by 4.94%, following a 3.30% decline the week before. This downward trend may not raise concerns among farmers and exporters because it is still 26.51% more valuable year-to-date.

Cashew remains one of Nigeria’s most important non-oil exports. In 2024 alone, the country exported over ₦400 billion worth of raw and shelled cashew, up significantly from ₦193 billion in 2023. The crop consistently ranks among the top five most internationally traded food commodities in Nigeria, with Vietnam, India, and the EU among the major buyers.

However, the recent price decline could present a major challenge to Nigerian exporters who were hoping to seize new market opportunities created by shifting global trade dynamics. For instance, the United States recently imposed higher tariffs on Vietnamese agricultural imports. Vietnam currently supplies $746 million worth of cashews to the US out of a total $843 million cashew import market. With Vietnamese cashews becoming more expensive, Nigeria could potentially fill some of that gap—if it can remain price competitive and ensure consistent quality and volume.

To fully capitalise on this opportunity, stakeholders in Nigeria’s cashew value chain may need to shift focus beyond raw exports. Vietnam’s dominance in the global cashew market is largely due to its strong processing industry, which transforms raw cashews into premium products for global markets. Nigeria currently exports most of its raw cashews, losing out on the higher margins available through processing and value addition.

Investing in local processing infrastructure and improving supply chain efficiency could help Nigeria move up the value chain, create more jobs, and reduce vulnerability to volatile raw commodity prices.

Meanwhile, cocoa beans price surged by over 26% as it climbed from ₦8,900 to ₦11,300 in one week. Although it is still a long way from its record ₦15,917 per kg price tag back in 2024. A major source of worry for exporters but not for processors who will be getting the commodity cheaper.

Soybean prices dropped by 4.6% after jumping by 5.41% a week prior. Maize price fell by 1.33% while paddy rice and sorghum recorded no significant price changes during the period.