Questions answered in this article:

– What is the state of Nigeria’s poultry sector and what factors hinder local production in the subsector?

– How does the price of maize and poultry feed interact and how have they changed in the first nine months of 2023?

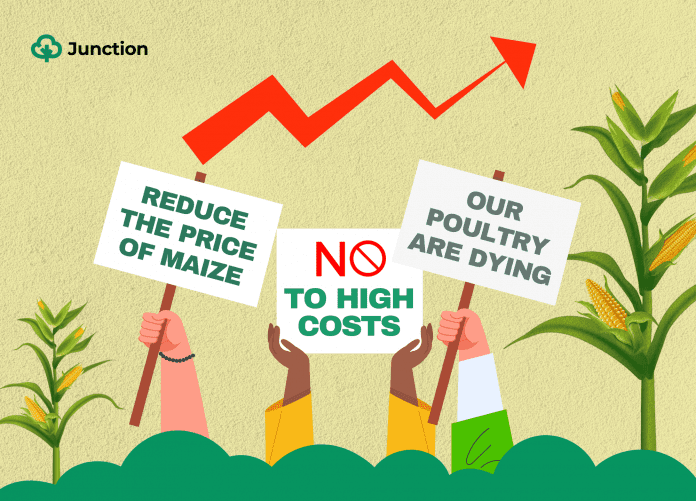

A silent struggle is unfolding in the heart of Nigeriaâs poultry farms. As the sun rises, farmers are battling a relentless foe: the soaring cost of poultry feed. With every grain that empties their pockets, they fight to keep their feathered flocks alive, juggling survival and sustainability in a high-stakes game of poultry farming.Â

Poultry output this year (2023) is at risk of reducing due to the record-high price of maize, which is an integral ingredient in poultry feed in Nigeria. What is behind the increasing cost of maize in Nigeria? That is what weâll explore in this article. But first, weâll touch on an overview of the poultry sector in Nigeria, highlighting its opportunities that continue to tide insufferable poultry owners in the face of soaring costs.Â

Nigeriaâs poultry sectorÂ

Poultry is rather critical to the Nigerian economy. It falls under the livestock subsector, the second-largest agriculture subsector. It is also the second-largest in Africa, boasting over 180 million birds (70% broilers and 30% layers), accounting for up to 454 billion tonnes of meat annually. This plays a massive role in plugging the protein deficiency in Nigeria.

However, there is still room for more production as local production only meets 30% of the domestic demand for eggs and chickens, which presents the country with more business opportunities. Most of the production is done in the southern part of the country.

The consumption of local poultry meat in Nigeria has been on the rise in recent yearsâdue to several reasons like the border closure and increased urbanisationâwith an estimated 4.5% increase in 2021 compared to 2019. To meet this demand, production has also been on the rise.

However, this production increase has been hampered by the high cost of animal feed for most farmers. According to a study by the International Food and Agribusiness Management Association (IFAMA), poultry meat and egg prices do not vary proportionately with the rising feed prices and other costs confronting producers. Poultry feed typically made up of cereals and grains, makes up about 70% of the cost of inputs for poultry farming. Unfortunately, the cost of these inputs has risen significantly over the years.

This has hurt the earnings potential of poultry farmers in Nigeria.

Prices are up, up, and upÂ

There are several reasons for the rise in animal feed prices in Nigeria. One of the main reasons is the high cost of inputs such as maize and soybeans, the main ingredients in poultry feed. These are two of the primary grains produced in Nigeria.

Nigeria is the second-largest producer of Maize in Africa and the 14th-largest globally. Maize output is about 11 million tonnes annually, according to the Food and Agriculture Organisation (FAO). However, the farmersâ association believes that production output is around 20 million tonnes annually. Regardless, this seems less than the countryâs 15 million tonne demand for Maize. This means that despite its high production, Nigeria remains a net importer of this grain. In 2021, Nigeria imported 9% more maize than it exported. This makes suppliers subject to volatility due to the exchange rate changesâas maize importation is not eligible for access to official foreign exchange.

Locally, maize production is also volatile, which affects the prices.Â

The maize farming landscape in Nigeria is marred by a constellation of challenges that collectively undermine its potential. Chief among these is the vexing issue of inadequate financing. Limited collateral among smallholder farmers leaves them reliant on government-backed initiatives such as the Anchor Borrowers Programme (ABP) and the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL). While these programs offer some relief, the need for diverse funding avenues remains critical.

Compounding the problem are subpar agronomic practices prevalent among small-scale farmers. Ignoring essential practices like proper use of fertilisers, pesticides, and herbicides leads to lacklustre yields, a setback further exacerbated by utilising low-yield maize seed varieties. These suboptimal strains, prone to diseases, pests, and droughts, underscore the necessity for broader adoption of higher-yielding hybrid varieties, despite reluctance among some due to tradition or perceived high costs and unavailability.

In addition, the spectre of insecurity casts a long shadow over maize farming. Ongoing clashes between herders and farmers wreak havoc on production In 20202, for example, it prompted the Maize Association of Nigeria to reduce production targets.

Climate change exacerbates challenges, manifesting as erratic rainfall patterns that trigger prolonged droughts or sudden, destructive floods.Â

Storage and distribution inefficiencies worsen the issue, resulting in maize going to waste due to inadequate facilities. High transportation costs due to structural bottlenecks like rising fuel prices and bad roads also pose a challenge.Â

Confronting these multifaceted challenges mandates diverse financial solutions, improved agronomic practices, wider seed adoption, enhanced security measures, climate-resilient strategies, and substantial investments in storage infrastructure. Only by addressing these interwoven issues can the maize farming sector in Nigeria genuinely flourish.

Finally, the most recent cause of the maize price increase is poor supply across the country due to the poor climate conditions. This has caused the price of maize to increase by 100%, with a tonne of maize costing â¦480,000 in August 2023 from â¦227,500 in June of the same year. Note that this is much more expensive than importing maize â¦285,000 per tonne. It has caused an over 30% increase in the price of animal feed to â¦8,000 as of August 2023 from â¦6,000 per bag in January.Â

Soybean production also faces similar hurdles.Â

Soybeans are a crucial crop in Africa, providing a source of inexpensive protein and addressing the protein deficiency in the average African diet. Nigeria is the largest producer of soybeans in sub-Saharan Africa, followed by South Africa and Zambia. However, soybean production in Nigeria faces challenges like those discussed already, including low yields and a shortage of improved varieties.

Farmers are getting creative

So far, weâve seen how much more expensive the feed cost is, pushing farmers to the limit and reducing their production prospects. The high cost of feed, mainly due to the high cost of maize, is a significant challenge facing the poultry industry in Nigeria. To mitigate its effects, poultry farmers employ various coping strategies, including reducing stock sizes, switching to cheaper feed alternatives, producing their feed, and forming cooperatives to purchase feed in bulk.

In the extreme, the high surges in maize prices and the near absence or scarcity of the product are causing farmers to close down their poultry farms. According to the Director General of the Poultry Association of Nigeria (PAN), Akpa Onallo, the high feed cost and the scarcity of maize have continually strained poultry farmersâ finances, making it difficult to sustain their operations.Â

With the high feed cost, poultry farmers may struggle to maintain profitability. Thus, closing their farms allows them to cut their losses and avoid further financial hardship. The poultry industry in Nigeria has begun shrinking due to the high feed cost. In Q2 2023, the poultry industry shrunk by 2.3% and 30.5% in Q1 2023.Â

In such a challenging environment, closing down their farms may be a strategic decision for farmers to protect their livelihoods and explore alternative opportunities.Â

Therefore, the government must intervene to reduce the high feed cost. They can do this by subsidising the price of critical ingredients such as maize and soybean in feed production..Â

So far, the government has made some moves to reduce the price of grains in the market. For example, it declared a state of emergency on food production in the country. The government also released 200,000 metric tonnes of grains from the strategic grain reserves to households, which should lower demand and reduce the price of these goods. Finally, it released 225,000 metric tonnes of fertiliser, seeds, and other inputs.

Farmers are embracing innovative approaches to produce feed for their livestock. One method involves using alternative feed ingredients like cassava, yam, and sweet potato peels. This practice aims to reduce the feed cost while maintaining the animalsâ nutritional needs. Additionally, using alternative ingredients in animal feed can help address concerns about the environmental impact of animal agriculture. By exploring these alternative feed ingredients, farmers can potentially lower their production costs and contribute to more sustainable farming practices.

Amidst the challenges, there are opportunities for developing the poultry feed industry in Nigeria. Investments in feed production facilities, such as modern milling operations, can help increase the availability of feed and lower costs. Improving access to higher-quality feeds can also enhance production efficiency and reduce costs.

Until 2022, the poultry sector had been expanding, yet local production still only meets 30% of the demand for chicken eggs and meat in Nigeria. It indicates a significant market opportunity for both small-scale and large-scale poultry farmers. Nigeria can strengthen its poultry sector, enhance food security, and contribute to its overall economic development by ensuring affordable and high-quality feed.

The rise in animal feed prices has been a significant challenge for the poultry sector in Nigeria. The high cost of inputs such as maize and soybeans and the high cost of transportation contribute to the price increase. Clearly, crop production plays a crucial role in determining the price of animal feed, and therefore, modern farming practices and government intervention are needed to ensure stable crop production. By addressing these challenges, the poultry sector in Nigeria can continue to grow and contribute to the country’s economy.