Nigeria’s food market is seeing a significant shift, with maize prices leading the charge in a broader trend of declining commodity costs. In the past week alone, maize prices dropped by 9.42%, bringing the total price decline since the start of the year to 23%. This sharp fall is offering welcome relief for consumers, farmers, and food manufacturers alike, especially in a country where maize plays a central role in diets and industry.

Maize: a pillar of Nigeria’s food system

Maize is one of Nigeria’s most important staples, consumed widely as boiled corn, pap (ogi), tuwo, and other traditional dishes. It is a vital source of calories, with per capita consumption estimated at 35 kg per year, contributing approximately 10% of daily calorie intake. In addition to being rich in carbohydrates, maize provides essential nutrients such as fibre, B-vitamins, thiamine, and magnesium, making it indispensable to household nutrition across the country.

Around 60% of the maize produced in Nigeria is used for animal feed, especially in the poultry, pig, and cattle industries. In poultry farming, maize makes up between 50% and 70% of feed formulations. Its high carbohydrate content ensures efficient energy supply, while by-products like corn gluten meal and distillers’ dried grains (DDGs) boost protein content. However, this heavy dependence on maize also means that feed producers are vulnerable to price volatility and supply disruptions.

It is also an essential raw material for Nigerian food manufacturers. Approximately 25% of locally produced maize is used in food and beverage processing, while an additional 13% is directed toward industrial production of items such as flours, cornflakes, confectioneries, and even brewing products. From starch to cooking oils, maize underpins a vast portion of Nigeria’s food processing value chain, making its affordability crucial for business sustainability.

Market prices and import relief

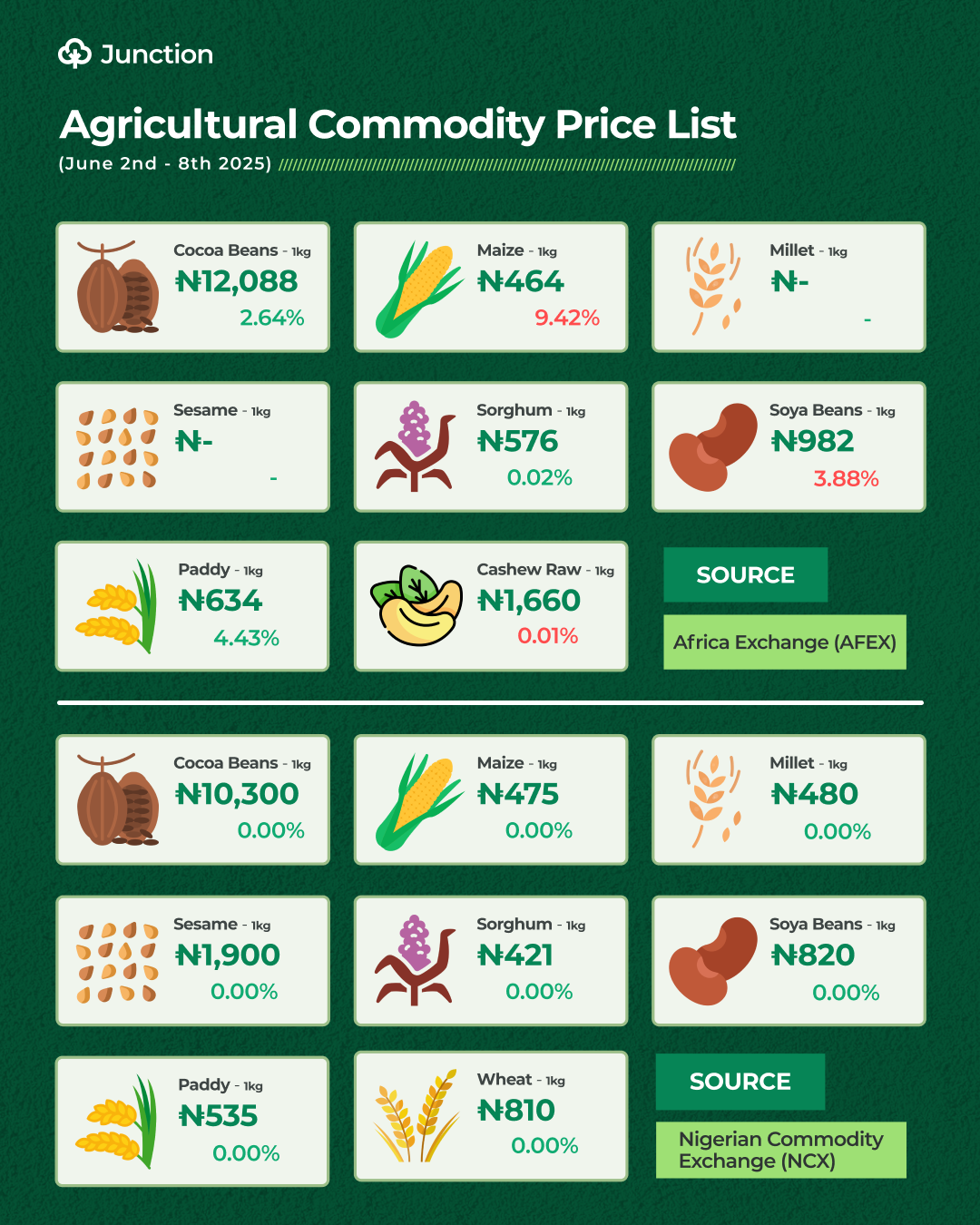

According to data from AFEX, maize currently sells for ₦450 to ₦500 per kilogram in Nigerian markets. Although slightly above its recent low of ₦430, this is a major improvement compared to the record-high price of ₦750. The downward trend has been widely attributed to President Bola Tinubu’s import relief policy, which has helped stabilise the supply of essential food items and weaken the grip of speculative hoarding.

The price drop is not limited to maize. Other essential staples, such as paddy rice and wheat, have also seen significant declines. BUA Foods Chairman AbdulSamad Rabiu credited the government’s import waivers for the market shift, noting that the policy has disrupted hoarding practices and created more competitive pricing.

Despite a recent climb in paddy rice prices from ₦520/kg to ₦630/kg since April, its overall market value has fallen by 19% in 2025.

Meanwhile, cocoa prices, after an earlier plunge of 25% in May, have begun to recover, now just 7.7% below their January levels. Cashew nuts have proven the most resilient, with over 30% growth this year despite minor recent declines.

The sharp decline in maize prices is a promising sign of stabilisation in Nigeria’s food economy. As import waivers and improved market supply begin to take effect, both consumers and industries are starting to feel the impact of greater affordability. While price volatility may persist in some commodities, the broader trend suggests a gradual rebalancing—one that could foster improved food security, lower production costs, and a more resilient agricultural value chain in the months ahead.