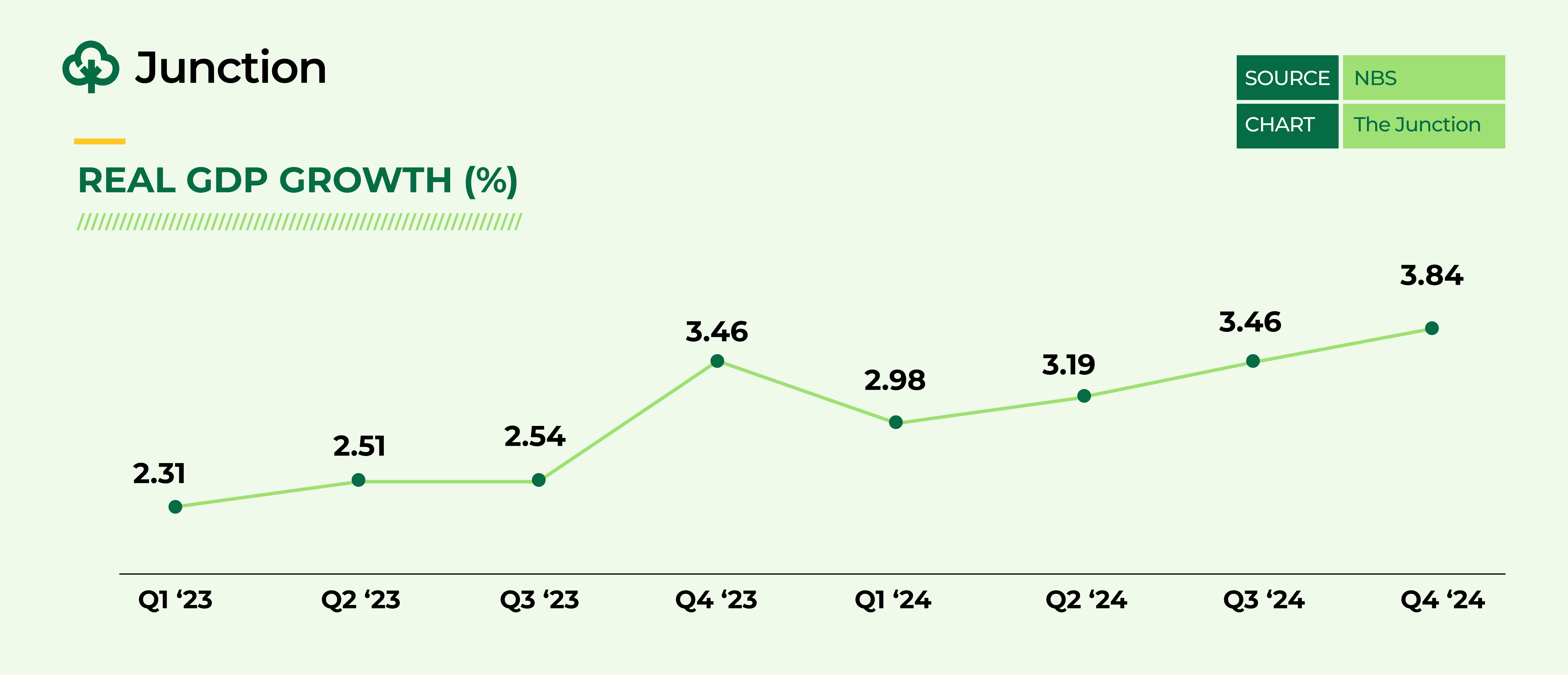

Nigeria’s economy demonstrated positive momentum in 2024, with the Gross Domestic Product (GDP) growing by 3.19% year-on-year in Q2, up from 2.51% in the same quarter of 2023. This growth also surpassed the 2.98% recorded in Q1 2024.

According to the National Bureau of Statistics (NBS), the services sector was the primary driver, contributing 58.76% to the GDP and expanding by 3.79%. The industry sector also recovered significantly, growing by 3.53%, a reversal from the 1.94% contraction in Q2 2023.

Agriculture sector performance in Q2 2024

The agriculture sector grew by 1.41% year-on-year in Q2 2024, showing a slight decline of 0.09 percentage points compared to Q2 2023 but a notable improvement from the 0.18% recorded in Q1 2024. Agriculture expanded by 7.35% on a quarter-on-quarter basis, demonstrating resilience despite persistent challenges.

When agriculture’s GDP grows during a specific period, it generally means that the value of goods and services produced by the agricultural sector has increased. It could mean more jobs and income opportunities, and ideally, it could translate to lower food prices if this growth is due to higher production.

The sector contributed 22.61% to Nigeria’s total GDP in Q2 2024, slightly below the 23.01% recorded in Q2 2023 but higher than the 21.07% in Q1 2024. Crop production remained dominant, accounting for 87.48% of agricultural GDP, reaffirming its central role in the sector and the wider economy.

Agriculture and economic growth in Q3 2024

In Q3 2024, Nigeria’s GDP grew by 3.46%, with the services sector maintaining its dominance, recording 5.19% growth and contributing 53.58% to the aggregate GDP.

The agriculture sector posted a modest growth of 1.14%, a slight drop from 1.30% in Q3 2023. Despite its importance in food security and employment, the sector continues to face challenges, including policy inconsistencies, climate risks, and limited mechanisation. Meanwhile, the industry sector showed signs of recovery, expanding by 2.18%, a notable improvement from 0.46% in Q3 2023.

Agriculture’s share of nominal GDP in Q3 2024 stood at 25.01%, slightly below the 26.36% recorded in Q3 2023. However, this marks a significant increase from 18.54% in Q2 2024. Within agriculture, crop production remained the largest contributor, accounting for 92.28% of the sector’s nominal value. The sector’s year-on-year growth in nominal terms was 11.29%, while quarter-on-quarter, it recorded a remarkable 57.53% growth, driven by seasonal harvest trends.

Q4 2024 GDP growth and agriculture’s role

In Q4 2024, Nigeria’s GDP expanded by 3.84%, up from 3.46% in Q3, bringing the full-year growth rate to 3.40%. This reflects the economy’s resilience amid inflationary pressures, currency fluctuations, and policy adjustments.

The services sector remained the biggest contributor, growing by 5.37% and accounting for 57.38% of the total GDP. In contrast, the agriculture sector grew by 1.76%, a decline from 2.10% in Q4 2023, while the industry sector saw a 2.00% growth, down from 3.86% in the previous year.

Nominal GDP at basic prices reached ₦78.37 trillion in Q4 2024, an 18.91% year-on-year increase from ₦65.91 trillion in Q4 2023. While non-oil activities remained the primary growth driver, agriculture continued to play a crucial role in Nigeria’s economy.

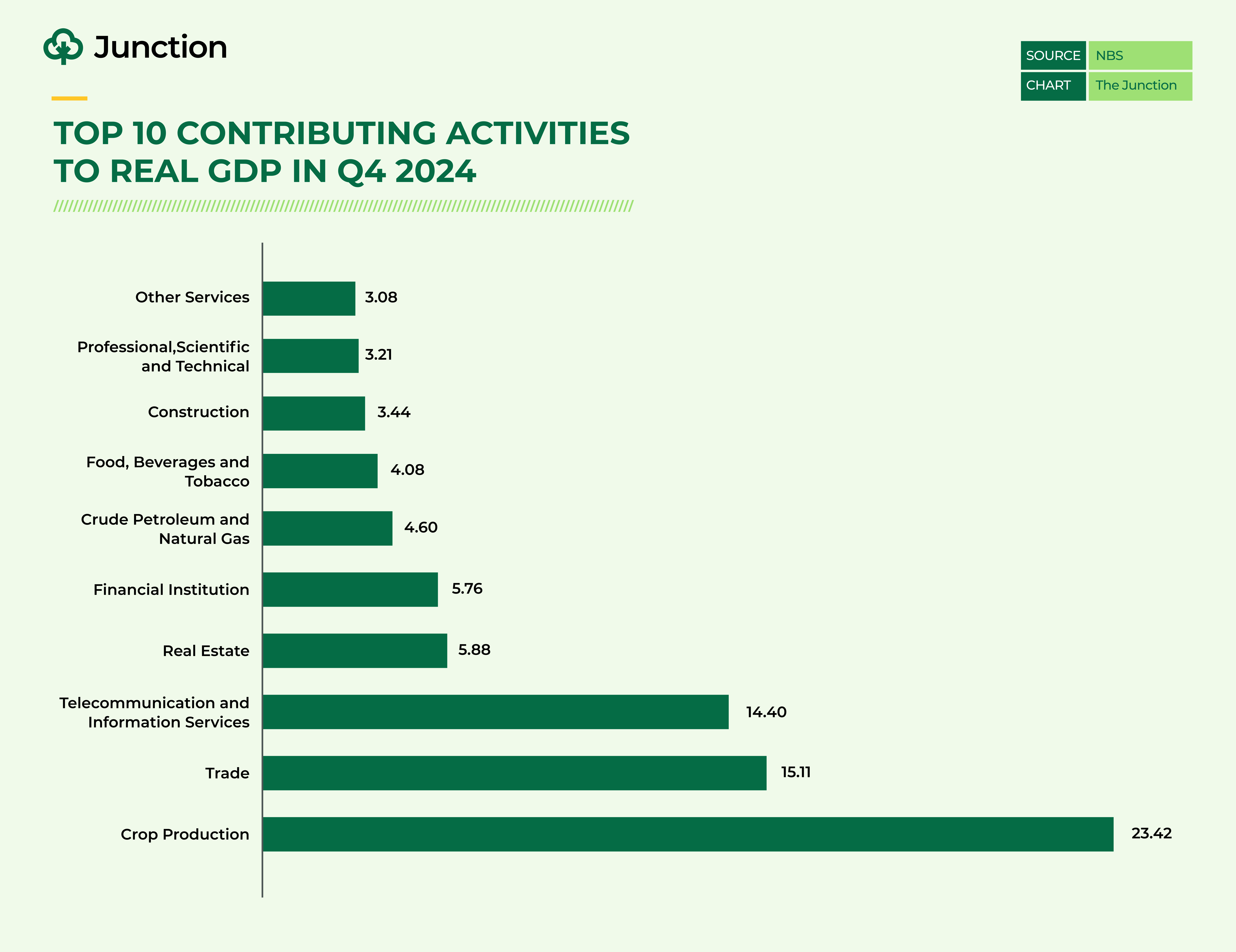

Crop production remained the single largest contributor to Nigeria’s real GDP, accounting for 23.42% in Q4 2024. This highlights its significance not only in ensuring food security but also in driving economic output and employment.

Other key sectors also contributed to GDP growth, including trade (15.11%), telecommunications (14.40%), real estate (5.88%), financial institutions (5.76%), and crude petroleum and natural gas (4.60%). These figures reflect the growing diversification of Nigeria’s economy, with digital services and commerce playing an increasingly vital role.

Outlook for agriculture and economic growth in 2025

As Nigeria moves into 2025, the agricultural sector remains a key pillar of the economy. However, its growth has been sluggish compared to other sectors. Tackling issues such as low productivity, post-harvest losses, and limited access to finance will be essential for unlocking its full potential. Expanding irrigation infrastructure, mechanisation, and targeted credit support could significantly boost output and improve overall sector efficiency.

The intersection of agriculture, trade, and technology presents significant untapped opportunities. Strengthening value chains through better storage facilities, processing industries, and digital market access can increase farmer earnings and reduce waste. The growing importance of telecommunications and financial services also opens avenues for integrating fintech solutions into agricultural financing. Additionally, expanding e-commerce platforms for farm produce could reshape the sector’s efficiency and market reach.

Projected growth and sectoral reforms

Nigeria’s agricultural sector is expected to witness substantial growth in 2025, with projections of an 8.10% expansion driven by various economic policies and sectoral reforms. Despite concerns over foreign exchange (FX) constraints, the government’s emphasis on local raw material sourcing presents an opportunity for agribusinesses to innovate and invest in domestic production. Improved access to finance, particularly through low-interest loans and subsidies for fertilisers and seeds, can enhance productivity. Additionally, the development of rural infrastructure, including roads and storage facilities, will help reduce post-harvest losses and improve market access for farmers.

Opportunities for farmers and agribusiness

Some analysts believe the sector is poised for a significant rebound in 2025 following the setbacks of previous years. The adoption of high-yielding crop varieties and increasing demand for staple crops like sorghum and cassava indicate a promising outlook. Sorghum, in particular, is emerging as a viable alternative to maize in the feed and brewing industries, presenting new opportunities for farmers and agribusinesses. The anticipated recovery is driven by both local market expansion and export potential, with stakeholders emphasising the role of young Nigerians in harnessing these trends for sustainable agricultural growth.

Challenges facing the agricultural sector

Despite positive growth projections, risks remain both locally and globally. Trade tensions between major economies, geopolitical conflicts, and disruptions in global supply chains could raise costs for agricultural inputs like fertilisers and machinery. Domestically, policy inconsistencies, insecurity, and climate change pose significant challenges to agribusiness growth. Addressing these risks requires proactive strategies such as diversifying supply sources, stockpiling critical inputs, and advocating for stronger agricultural policies. Additionally, investment in climate-resilient farming practices, including drought-tolerant crops and improved irrigation, will be crucial for long-term sustainability.

Budgetary allocation and investment concerns

The Nigerian government has allocated ₦826.5 billion to the agricultural sector under the 2025 Budget of Restoration. This investment will prioritise mechanisation, irrigation, and value-chain development to ensure the food sector supports economic diversification. However, concerns remain over whether the allocated funding is sufficient to drive the sector’s much-needed transformation. At just 1.73% of the national budget, the allocation remains far below the 10% commitment set by African leaders under the Maputo Declaration. Critics argue that while the government acknowledges the importance of agriculture, its financial commitment does not match its rhetoric.

Public-Private Partnerships and future prospects

Experts emphasise that agriculture should be treated as a business rather than a development project. Private sector involvement is key to unlocking the sector’s full potential. By fostering public-private partnerships, encouraging agribusiness financing, and creating an enabling environment for investors, Nigeria can bridge the funding gap and drive agricultural growth. Strengthening financial incentives for agripreneurs, supporting agricultural technology adoption, and ensuring market linkages for smallholder farmers will be critical in achieving the government’s food security goals. While the 2025 budget may fall short in direct allocations, strategic investments and private sector participation could still position agriculture as a pillar of Nigeria’s economic growth.

Great Job.

Ayodele Otaiku DSc. | FAIPA, FIMS, FIAMN, FICM

ARATIBIOTECH Limited -Regenerative Agriculture

Managing Director/Chief Scientist

+234 803 3721 219 WhatsApp mobile

http://www.aratiagro.org | ayodeleotaiku@aratiagro.org

Web-Link Profile |

https://nda-ng.academia.edu/AyodeleOtaiku

https://www.adscientificindex.com/scientist/ayodele-a-otaiku/4922295