Questions answered in this article: - How does agro-financing in Nigeria, under the Anchor Borrowers' Program (ABP) work? - What positives can be taken away from the ABP and in what areas is the scheme still lacking? - Compared to India's Cent Agri Infra Scheme, how can the ABP be made better by the Tinubu administration?

My last article explored whether agro-financing has been effective in Nigeria. By exploring food price changes, capital flows, and agriculture export earnings, we saw that agro-financing schemes have yet to achieve their common objectives and, therefore, are still ineffective.

In addition, it is important to note that agro-financing, though ineffective, is largely hampered by existing structural issues within the country which make the sector as a whole risky. We explored this, briefly, in the last article and this gave us some insight into the sentiments of agro-financiers generally, which would typically play a role in determining how extensive agro-financing can go. However, it is very important to understand the demand side (from the borrowers’ perspective) to gain a complete perspective on agro-financing.

The best way to investigate this would be to survey a sample of borrowers, collate the responses, represent responses as visualised data, and draw insights from the results. However, this is a time and resource-intensive process which directs us to explore the next best alternative; highlighting a major domestic agricultural borrowing scheme and discussing how it works in detail.

We shall focus on how agro-financing works in Nigeria by spotlighting the Anchor Borrowers’ Program (ABP). The reason is its sheer prevalence as the foremost agro-financing scheme in the country at the moment.

For context, the Central Bank reported that the Commercial Agricultural Credit Scheme Fund (CACS) had disbursed ₦745 billion worth of agriculture loans from its inception in 2009 till date. However, the ABP disbursed ₦1.09 trillion to more than 4.6 million smallholder farmers based on the most recent figures in 2023. Consider that the CACS had a six-year head start on the ABP.

In this article, you will see the necessary details for consideration to access financing under the ABP. This will provide visualisation of agro-financing from the perspective of a borrower and will, in fact, grant us insight into the level of ease of access to finance under the CBN’s flagship agro-financing initiative. First, let’s take a slight detour to understand the goal and objectives of the ABP.

How does the Anchor Borrowers’ Program work?

The ABP was established to create economic linkages between smallholder farmers and anchors (respectable corporations, and state governments) involved in producing and processing specific agricultural commodities. At its core, it focuses on providing loans (in cash and kind) to smallholder farmers to boost agricultural production, improve employment, and reduce food importation to conserve foreign reserves.

The structure of the ABP makes it distinct from other agro-financing schemes in the country, as it doesn’t just issue financing based on mere applications, or recognizes the prerequisite of anchor sponsorship, thus developing business supply chains in the process. This provides a foundation for value-added consumer goods and potential exports. In this regard I would say that the ABP works overtime by going beyond a traditional application and loan model.

Before we move on to the nitty gritty of the procedure, let’s look at the objectives of the ABP in concentration.

ABP Objectives

The common goals of agro-financing include increasing employment, revenue diversification, improving access to finance in the sector, increasing export earnings, and enhancing food supply & stabilising food prices.

These broader goals form the core of the ABP which in turn goes further to include the following specific objectives:

- Increasing banks’ financing to improve agricultural productivity by creating an ecosystem that drives value-chain financing;

- Reducing the nation’s food import bill through import substitution and enhanced domestic value addition;

- Creating a new generation of farmers through innovative financing to support smart agriculture;

- Deepening financial inclusion and growing smallholder farmers from subsistence to commercial farming.

At a glance, the objectives tell us that the programme is not just trying to make lending more accessible. It strives to improve the structure of the agriculture value chain in general while developing farmers’ productivity on a journey to national self-sufficiency in food production.

Now that we understand what the ABP is all about and its desired end goal, we can dig into its process.

Targeted beneficiaries and commodities

It is essential to develop an understanding of the intended beneficiaries of the ABP . The CBN’s guidelines on the ABP reveal that the targeted beneficiaries include smallholder farmers and medium to large-scale farmers producing agricultural commodities across the country.

Also, smallholder farmers are expected to be in groups, cooperatives, associations, or part of an out-grower scheme (we shall discuss this in due time) to benefit from it. In addition to being an intended beneficiary, increasing the likelihood of accessing finance under the ABP is heavily reliant on being a producer of the particular commodities that the scheme prioritises. The commodities covered under the programme include cereals, cotton, root and tuber crops (cassava, yams etc.), sugar cane, tree crops (palm oil, etc.), legumes (soybean, cowpea, etc.), tomatoes, and livestock. The guidelines do not state any absolute restriction to only these commodities but does mention that the bank may periodically determine any commodities outside those mentioned earlier.

Now that we have examined the targeted beneficiaries and commodities covered under the scheme, it’s essential that we also know the key stakeholders as well. The primary stakeholders are:

Stakeholders

There are participating financial institutions (PFIS), which serve as intermediaries between the CBN and prospective borrowers under the scheme. Eligible PFIs under the ABP are Deposit Money Banks (Commercial Banks), Microfinance banks, non-interest banks, and development finance institutions.

The Anchor i.e. the company/government department that engages in the production and processing of agricultural commodities, must be a duly registered entity with the capacity to off-take produce (absorb the farmer’s produce) at an agreed price.

Service providers are registered entities that provide support services crucial to the farming operation and supply, distribution and auxiliary support services such as monitoring. A service provider is not constrained to these services alone, but other services included in the contract (known as an SLA or service level agreement).

Insurance Companies are also vital stakeholders because the agricultural insurance products they provide to farmers, protect them from losses. Other stakeholders include state government and ministries, departments and agencies (MDAs).

Eligibility criteria for different parties under the ABP

There’s one last facet to explore regarding the ABP: the models of implementation, which stand as windows under which it can be accessed.

Models

The ABP is administered through two windows: The private and public-sector-led windows. Recall that earlier on, I said that the programme was established to create linkages between smallholder farmers and anchors (corporations and state governments). The private-sector-led window is the medium by which corporations access the ABP. In contrast, the public-sector-led window is the medium by which state governments and other public institutions may access it.

These two windows, in conjunction, give rise to the following three models:

The Prime Anchor Model is where the agro-processor/off-taker is the primary obligor and takes full responsibility for anchoring the farmers or deploying complete mechanisation for production.

The Commodity Association/Cooperative Model has the farmers as the primary obligors. The commodity association/cooperative at the state level is to identify and organise its members to participate in the programme. It would be required to provide collateral to support the loan for its members.

Under The Public Sector Model, the state government guarantees the farmers participating in the programme and will be responsible for loan repayment and off-take of produce.

The first two fall under the private sector-led window, while the last falls under the public sector. Due to unavailability of granular data it is quite difficult to determine which model under the ABP is most effective. However, the prime anchor model seems to be the most prevalent model due to its structure with private sector corporates as primary off-takers.

To avoid protracting this segment, we would conclude here and explore the modalities involved in the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending. At this juncture, we can now gain granular and specific insights on how financing is gotten under the ABP.

Getting the bag

The anchor kicks off the process by expressing its interest to the PFI, who subsequently relays the interest to the CBN on behalf of the anchor, government, or cooperative/commodity association.

Next, the CBN establishes a project management team to determine production economics (EoP) and off-take prices. Furthermore, the PFI, anchor, and the farmers’ representatives develop and sign a threefold agreement.

This then triggers the PFI to submit the loan documents to the CBN, and the CBN, in turn, will issue an offer letter and disburse funds upon confirmation that it satisfies all conditions for disbursement.

Activities post disbursement involve farmers’ registration on the National Collateral registry, disbursement into the farmers’ accounts, and payment to the service providers shall be debited from the farmers’ accounts. At this point, repayment and/or loan recovery becomes the primary focal responsibility of all parties.

Overall, what does this tell us? Uncertainty.

The ABP is subject to a lot of conditionality, and this can be seen in key factors such as: loan limits, average interest rate, and tenor. The maximum loan limit is dependent on CBN-ratified EoP. This means that the loan limit depends on your eligibility and qualification for the loan you want to obtain. The interest rate is determined by the prevailing interest rate for intervention funds (currently at 9% P.A.) as prescribed by the CBN from time to time. As for tenor, it is based on the gestation period of the targeted commodity, that is, the amount of time it takes from planting till harvest.

There are a lot of factors still at the discretion of the financiers which would make the process of accessing finance quite uncertain for borrowers. However, the major concern to financiers is the documentation requirements. Information obtained from reliable sources reveals that on average when all responsibilities are met by all parties, as well as all documentation readily available the turnaround time from application to disbursement is typically two to three weeks (base case i.e. the expected outcome) whereas the worst case is typically one month. It is also interesting to note that the strength and popularity of the anchor play a pivotal role in determining how fast such applications can be converted to disbursements.

So, What’s next?

Despite some of the issues flagged with the ABP, it is still the flagship agricultural intervention scheme, and rightly so, because it’s disbursement volume is quite significant (4.6 million farmers in 8 years), but it can still be better. What do I mean?

Up till this point, I’m sure you will realise that it’s quite a lengthy and cumbersome process to access financing under the ABP. In this regard, a possible counter to this would be to digitise the entire application process. This limits the time the CBN takes to commence its due diligence and ensures faster turnaround times for application processing and eventual disbursement.

Let’s paint a mental picture. Imagine an anchor (let’s say Flour Mills) logging on to the ABP portal on the CBN website, selecting which model applies to its (the anchor’s) situation.

Step two would be to select the preferred PFI and input all relevant details such as account details, BVN and/or TIN (Tax Identification Number) etc.

What follows naturally should be to upload all necessary documents, just as you would upload a CV or a cover letter on an application, and, voila! the entire process is reduced to just a fraction of the overall time it would have taken under the existing approach.

Also, as much as the ABP has immense benefits for the agricultural sector and the smallholder farmers, it is necessary to state that agro-financing is not the same as charity/philanthropy. It falls under the development financing category, i.e. financing structures and models aimed at strategic sectors and projects to drive economic development.

In light of this, repayment of the loans under the ABP (and any other agro-financing scheme) must be continuous and uninterrupted to preserve the programme’s sustainability. As at 6 March 2023, the CBN revealed that the loan repayment ratio under the ABP currently stands at 52.39%. This tells us that just over half of all loans under the ABP have been repaid. However, the IMF estimates that repayments sit at 24%, this has sparked debates among stakeholders about the implementation and feasibility of continuing the ABP. The CBN guidelines on the Anchor Borrowers’ Program do not emphasise the measures to limit the credit risk of default on such loans to smallholder farmers.

Therefore, there should be increased measures by the anchor, the PFI, and the CBN’s project management team to recover losses and limit credit default risks.

However, give to Caesar what is Caesar’s. There are a lot of positives to take from the ABP, and one that stands out to me is the structure. The scheme is designed on the belief that a considerable proportion of the farming population is subsistence and not commercial. It accounts for this and can coincide the needs of corporations with the needs of farmers, thus ensuring guaranteed output and a guaranteed off-take. This is not only economically sensitive but demographically sensitive.

ABP vs Cent Agri Infra Scheme

However, internal assessments never paint a complete picture, and that is why benchmarking is so important to understand the extent of individual, corporate, and economic performance. To fully understand how well the ABP is performing, I have taken the liberty to compare it against similar intervention schemes in other similar economies and demographics.

My research took me to India, a country with a similar demographic, similar income level and also similar level of participation in Agriculture. For context, Nigeria’s agric contribution to GDP in Q1 2023 is 21.37% while India’s agric contribution to GDP is 18.3%. A quick search on the Central Bank of India’s website revealed no less than 25 loan schemes. All directed at different issues and aspects of the Agricultural value chain. This, to me, was the first strike on the ABP, and I’ll explain why; but first I selected one scheme, the Cent Agri Infra Scheme as a use case to compare against the ABP.

Three things stand out in the above table: purpose, security and eligibility. The Cent Agri Infra scheme is more specific in what aspect of the value chain it is trying to support. It also has a wider net of eligible participants to finance and the security required is not as stringent as the ABP. This takes me back to the comment made before that there are no less than 25 agro-finance schemes on the Central Bank of India’s website all of which attend to specific areas of an agri-business value chain. The ABP is not so clear and distinct, it supports SHFs on the basis of expected crops produced and isn’t specific to any segment of the value chain. This essentially reduces complete transparency in use of proceeds (no wonder default rates are high). Ultimately, the ABP seems to be overworked from a demand side which has not only reduced the viability of the scheme but also seen it disburse funds to less deserving borrowers.

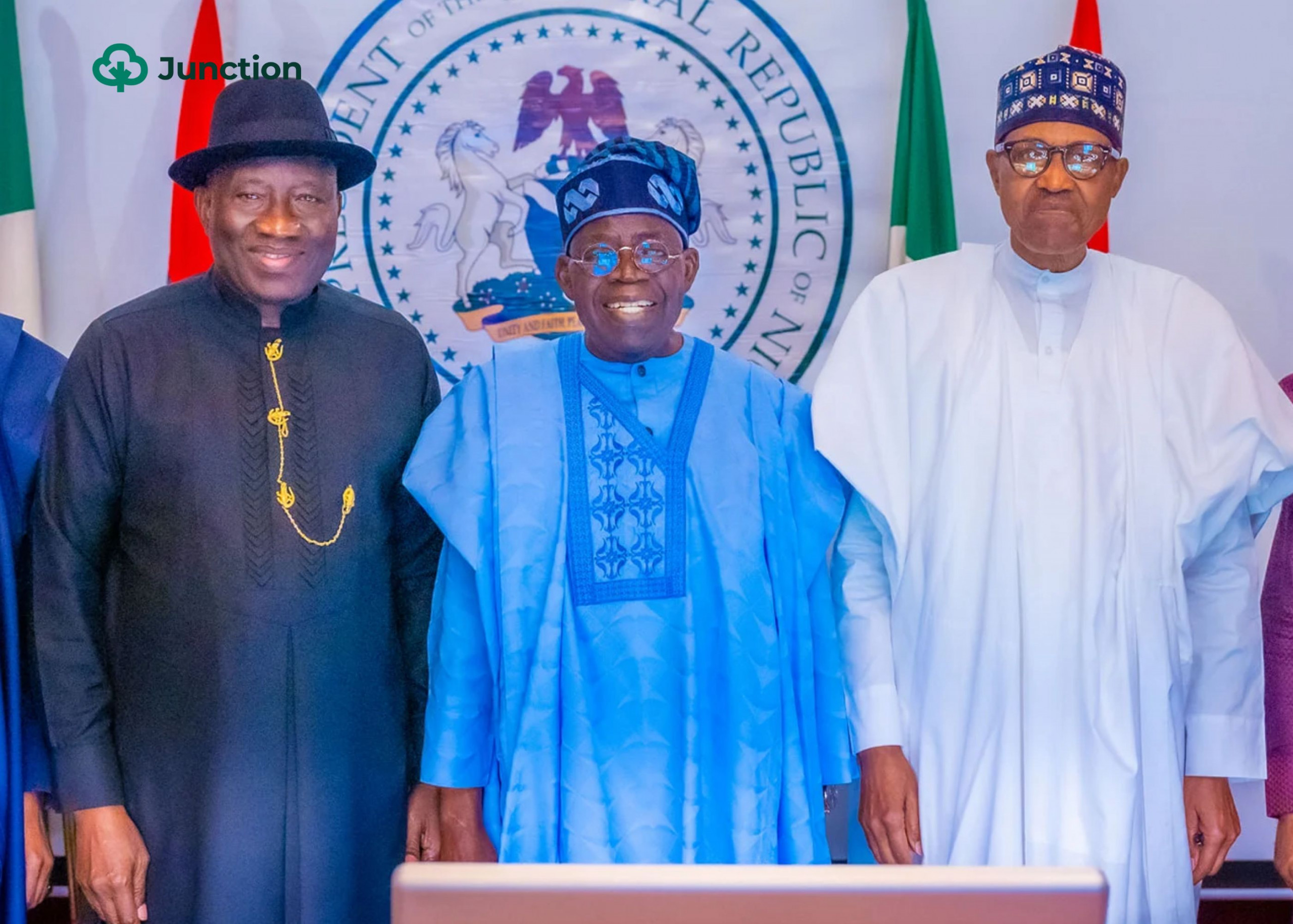

The verdict, though, is that the scheme is sub-optimal. I started this piece by stating that Agro-financing has been ineffective but the structural issues in the country have largely made agriculture, as a whole, a very risky sector which accounts for the bearish sentiment for Agro-financiers. Silver-lining, there is a new administration in place- the Tinubu presidency has so far revealed a number of initiatives directed at developing Agriculture in the country.

The President’s inaugural address highlighted specific plans for agriculture which include: the development of agric hubs across the country; introduction of best practices to livestock farming; nationwide storage programs. Also, on July 13, 2023, President Tinubu declared a state of emergency on food security while making available 500,000 hectares of arable land for agriculture. In addition, plans to create synergies between the Ministry of Agriculture and the Ministry of Water Resources have commenced to ensure adequate irrigation of farmlands for stable food production. The only issue is, will these plans come to fruition, and will they be properly implemented?

Structure, environments, and implementation matter for any policy to work, the ABP has not been graced with the best structure, environment, and implementation approach; yet it has contributed to a boost in Nigeria’s rice and maize sector. The rationale behind the ABP is solid but with a sub-optimal structure, poor implementation, and a system that does not incentivise repayment of loans, it’s just counterproductive and a waste of necessary resources.

The new administration has set some expectations regarding improving agriculture. If these plans are realised and implemented, it would de-risk the sector, making Agro-financing feasible. Add detailed restructuring of the ABP and it can lead to immense holistic development in Agriculture and may have the desired macro-economic impact on food prices, export earnings, and food security.

While it might all seem hypothetical, I strongly believe the ABP, under the right circumstances can be a game changer for the agriculture sector if it is even retained by the Tinubu administration.