Ghana has allocated GH₵1.5 billion (approximately ₦148.87 billion) towards its Agriculture for Economic Transformation Agenda (AETA), a strategic initiative to modernise agriculture, enhance food security, and generate jobs. However, this allocation represents only 0.52% of the country’s GH₵290 billion budget.

Meanwhile, Nigeria’s 2025 budget dedicates ₦826.5 billion to agriculture, accounting for 1.73% of its ₦47.965 trillion total budget.

Why agricultural budgets matter

Picture neighbours who live in a bustling community and take pride in preparing grand meals for their dependents. Although they understand the importance of keeping their kitchens well-stocked, their strategies differ when shopping for groceries.

One could approach the market with a modest wallet, carefully calculating how to get the best value with limited funds. The other may go with a heavier purse, confident that spending more will cover all essentials—though not always with a clear plan for what ends up in the cart.

Now, replace these neighbours with nations of the world, including Ghana and Nigeria. Their grocery runs represent their agricultural budgets. All countries understand the critical role of agriculture in feeding millions, providing jobs, and fueling economic growth. Yet how each chooses to allocate and manage agricultural spending tells a different story—one shaped by priorities, resources, and strategy.

Agriculture is the backbone of many economies. It underpins food security, employs a significant chunk of the workforce, and contributes meaningfully to Gross Domestic Product (GDP). Recognising this, the 2003 Maputo Declaration urged African nations to allocate at least 10% of their national budgets to agriculture.

Neither Ghana nor Nigeria currently meets this benchmark. As already stated, Nigeria allocated 1.73% of its total budget to agriculture, while Ghana committed just 0.52% in 2025.

But why should you care about these percentages?

Underfunding—or mismanaging—agriculture is like skimping on ingredients for a big family meal. The consequences are real: rising food prices, ballooning import bills, shrinking job opportunities in rural areas, and a dwindling food basket.

At this point, you might be thinking, “Budget allocations sound like the government’s business. How does this affect me?”

Let me break it down:

- That bag of rice that keeps getting pricier every market run? Closely tied to how much (or how little) we invest in our farmers.

- Tomatoes, onions, and bread costing more each week? Influenced by the strength—or weakness—of policies behind agriculture budgets.

- Youth unemployment? A reflection of untapped potential in agriculture. Over 70% of Nigerians engage in agriculture, mainly at a subsistence level. In Ghana, a significant portion of the population depends on farming, with 70% of farmers involved in cassava production.

Breaking down the numbers: how the money will be spent

In the budget speech, Ghana’s Finance Minister, Dr Cassiel Ato Forson, emphasised that the AETA will reshape agriculture by addressing immediate challenges and ensuring long-term sustainability. Key projects under this initiative include the Feed Ghana Programme, the Ghana Grains Development Project, the Vegetable Development Project, and the Nkokor Nketenkete initiative.

The Feed Ghana Programme is also expected to boost food production and reduce import dependence, creating job opportunities. The Ghana Grains Development Project targets self-sufficiency in maize, rice, and sorghum production, while the Vegetable Development Project aims to expand domestic consumption and exports. Additionally, investments will be made in modern farming techniques, agricultural infrastructure, and research and development to attract local and foreign investors.

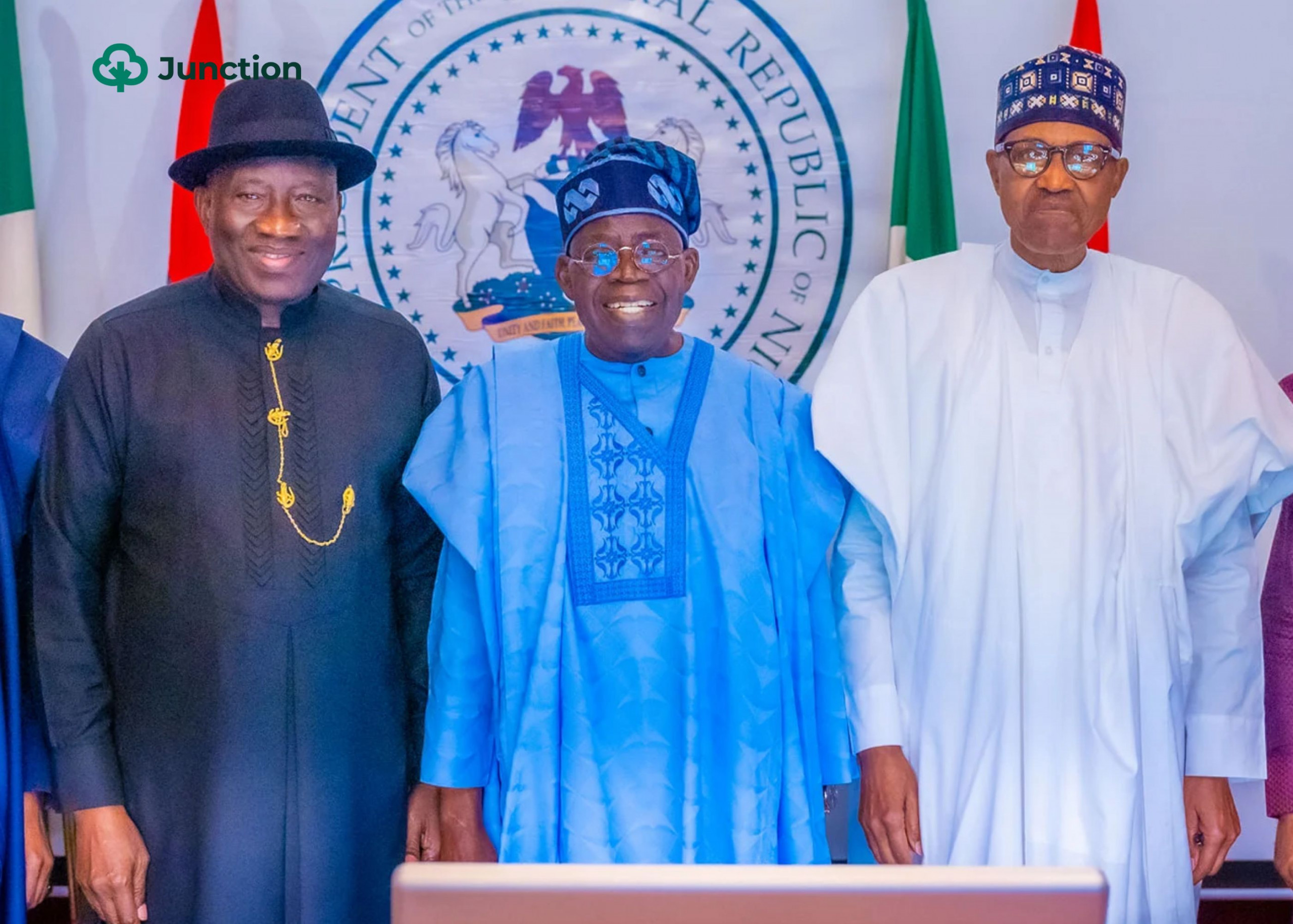

Conversely, Nigeria’s 2025 budget, tagged the Budget of Restoration, prioritises security, infrastructure, health, and education, leaving agriculture with a minimal allocation. While President Bola Ahmed Tinubu acknowledged the sector’s role in economic diversification, experts argue that the budgetary commitment is insufficient to drive real transformation.

Nigeria’s agricultural investment will focus on mechanisation, irrigation, and value-chain development. The Renewed Hope Fertilizer Support Program (RH-FSP), for example, aims to enhance fertiliser production and distribution to curb food-induced inflation.

However, with agriculture contributing over 26% to Nigeria’s GDP, analysts believe the allocation falls short of expectations. Ghana is also heavily reliant on agriculture, with its GDP owing 24.5% of its value to the sector in 2024.

Another way to understand the impact of these allocations is by examining the budget on a per-household basis:

- Nigeria has approximately 40.2 million agricultural households. An agricultural budget of ₦826.5 billion translates to about ₦20,560 per agricultural household.

- As of 2018, Ghana had around 2.6 million agricultural households. An agricultural budget of GH₵1.5 billion (approximately ₦148.87 billion) equates to about ₦57,258 per agricultural household.

Thus, despite Nigeria’s higher overall allocation, Ghana’s budget translates to more per household, raising questions about efficiency, strategy, and impact.

Ghana’s AETA focuses on technological advancement, improved credit access, and strengthening agribusiness opportunities. The blueprint is ambitious—seeking to modernise farming and elevate productivity.

However, the relatively modest budget (₦148.87 billion) may limit the programme’s reach. A grand plan without adequate funding risks becoming an undercooked dish: full of promise, short on delivery. This underfunding could slow progress on food security, job creation, and economic transformation.

Nigeria’s agricultural budget of ₦826.5 billion does not signal a serious financial commitment as its ratio to people in the sector reveals. There’s potential to address critical challenges like ageing infrastructure as infrastructure development corners a bulk of the budget. However, limited access to modern farming tools and weak support services for farmers may continue.

Without strategic planning, policy consistency, effective implementation, and addressing insecurity issues these plans may not be fully realised.

A global lens: how other countries invest in agriculture

To put things in perspective, let’s look at agricultural giants:

- China: invests heavily in agricultural R&D, with annual expenditures of $10 billion as of 2015, reflecting a strong emphasis on innovation and efficiency in agriculture.

- India: Channels large investments into subsidies, credit access, and support mechanisms—though per-farmer calculations vary.

- USA: Offers substantial subsidies and financial bailouts to farmers, ensuring stability even during downturns.

Beyond budget figures, what matters is how well the funds are used, supported by clear policies and robust infrastructure. The lessons from these three countries show the diversity in focus as it pertains to the sector’s needs during specific periods.

China is more concerned about research than bailouts, for example, because prioritises food security, adaptation to climate change, production boost, resource conservation, and reduced environmental pollution.

India is offering subsidies and improving credit access because smallholder farmers who feed the nation require funding.

Meanwhile, America’s bailout funds are there to cushion the effects of the administration’s trade wars.

It is important to note that the strategies they employ to meet these needs differ, some may provide direct credit while the other could create competitions to encourage advancements.

Conclusion:

Agricultural budget allocations are more than just numbers; they reflect a nation’s commitment to its farmers and food security. Both Ghana and Nigeria have the potential to transform their agricultural landscapes. The key lies in not just the amount allocated but in the strategic deployment of these funds to address the real needs of the agricultural community.

Nigeria and Ghana can borrow a leaf from these existing funding manuals to ensure that their budget, while small, is focused enough to bring results.

Ghana’s AETA presents a focused, structured vision for agricultural transformation, though underpinned by a relatively lean budget. Nigeria’s larger allocation provides greater potential—but only if effectively managed, with strategic oversight and practical support for farmers.